How American First Finance Reports to Credit Bureaus: What Consumers Should Know

Understanding Credit Bureau Reporting by American First Finance

American First Finance (AFF) is a well-known provider of consumer financing solutions, including retail installment contracts and lease-to-own agreements. A key question for many consumers is whether AFF reports account activity to major credit bureaus such as Experian, Equifax, and TransUnion. The answer is nuanced, especially in light of recent policy changes and the type of financing product you select.

Source: confusedwords.org

Does American First Finance Report to Credit Bureaus?

American First Finance reports most account activity to credit bureaus, with important exceptions based on account type and date opened. According to AFF’s official disclosures and frequently asked questions, the company reports to credit bureaus for all accounts except for new lease-to-own accounts opened on or after January 1, 2024. If you opened a lease-to-own account before this date, or if you have other types of financing such as retail installment contracts, your account activity is typically reported [1] [2] .

This change does not impact customers in Arizona, California, and Florida, as reporting for lease-to-own accounts in these states was previously discontinued [1] .

What Is Reported and How Does It Affect Your Credit?

For accounts that are reported, AFF shares information about your payment history, outstanding balances, and account status. According to their collection disclosure, late payments, missed payments, or defaults may negatively impact your credit report and score [4] . Timely payments, on the other hand, can help demonstrate responsible credit use, which may benefit your credit profile over time.

Consumers have reported seeing AFF accounts on their credit reports, sometimes under categories such as retail loans or personal loans [5] . If you have an AFF account, it is important to regularly review your credit reports for accuracy and to ensure that all payments are made on time.

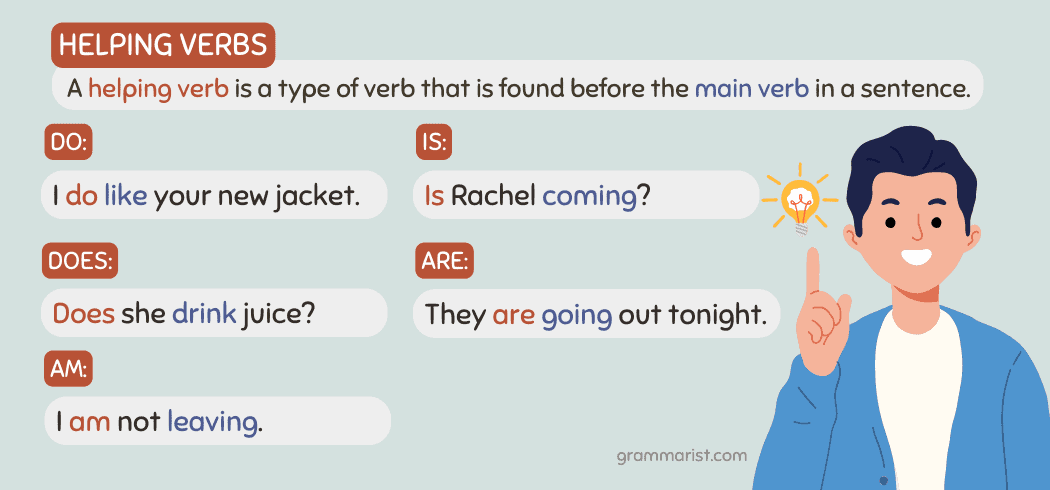

Source: pinterest.com.mx

Recent Changes to Reporting Practices

Effective January 1, 2024, new lease-to-own accounts are no longer reported to credit bureaus, except for accounts opened prior to this date or in states where reporting was already discontinued (AZ, CA, FL) [1] [2] . Additionally, new Retail Installment Sale Agreements will no longer report to Data X, a specialty credit reporting agency, but will continue to be reported to the major bureaus if they were previously subject to reporting.

This change was implemented to align with evolving industry standards and regulatory guidance. Consumers considering new lease-to-own agreements should be aware that these accounts may not help build or impact their credit history.

How to Monitor Your Credit If You Have an AFF Account

To keep track of your AFF account on your credit report, you can take the following steps:

- Obtain free annual credit reports through official portals such as AnnualCreditReport.com.

- Review your credit report for any entries from American First Finance. These may appear as installment loans, retail contracts, or other types of credit.

- If you notice incorrect or unfamiliar entries (such as an account you did not open), you can file a dispute directly with the credit bureau. Include documentation such as account numbers, billing statements, and correspondence with AFF.

- Contact American First Finance using the customer service options provided on their official website for account-specific questions or to initiate dispute resolution [1] .

Real-world examples demonstrate the importance of monitoring: Some consumers have filed complaints about erroneous AFF accounts appearing on their credit reports, which required contacting both the company and the bureaus to resolve [3] . These cases illustrate that proactive review and dispute resolution are key to maintaining accurate credit information.

What If Your Account Is Not Reported?

If you open a new lease-to-own account after January 1, 2024, in most states, your account will not be reported to the major credit bureaus. This means:

- On-time payments will not help build your credit history through this account.

- Late or missed payments will not directly affect your credit score via this account.

- You should consider alternative financing options if credit-building is a priority.

For consumers in Arizona, California, and Florida, these changes reinforce previous policies; lease-to-own accounts in these states have not been reported for some time [1] .

How to Access Services and Resolve Issues

If you need to access your account, dispute a transaction, or clarify reporting practices, you can:

- Visit the official American First Finance website and use their contact form or customer service phone numbers.

- Gather documentation (account statements, correspondence) before contacting support.

- For disputes appearing on your credit report, initiate a formal dispute with the bureau and provide supporting evidence.

- To resolve complaints, consider filing with the Better Business Bureau, which has a process for addressing consumer issues with AFF [3] .

Step-by-step guidance for disputing an inaccurate credit report entry:

- Obtain a copy of your credit report.

- Identify the entry in question and collect all relevant documentation.

- Visit the credit bureau’s official website and follow their dispute submission process.

- Contact AFF’s customer service to notify them of the dispute and request clarification.

- Track the progress of your dispute and request written confirmation of any changes.

Alternative Paths to Building Your Credit

If your AFF account is not reported or you want to build your credit profile more effectively, consider these alternatives:

- Apply for credit cards or installment loans from institutions that report to major bureaus.

- Use secured credit cards or credit-builder loans, which are designed to help establish a positive payment history.

- Check with your bank or credit union for products specifically geared toward credit improvement.

Potential Challenges and Solutions

Challenges may arise if you expect your AFF account to affect your credit and it does not due to recent reporting changes. In such cases, communicate directly with AFF for clarification. If you experience issues with account errors or disputes, maintain detailed records and escalate through formal channels as needed.

Summary and Key Takeaways

American First Finance reports most accounts to the major credit bureaus , but new lease-to-own accounts opened after January 1, 2024, are excluded in most states. Consumers should monitor their credit reports regularly, understand the implications of reporting changes, and pursue alternative credit-building strategies if necessary. For any specific issues or disputes, use official channels and provide thorough documentation for the most effective resolution.

References

- [1] American First Finance (2025). Credit and Reporting FAQs.

- [2] American First Finance (2025). Payment Solutions FAQs.

- [3] Better Business Bureau (2025). American First Finance, LLC Complaints.

- [4] American First Finance (2025). FinWise Bank Collection Disclosure.

- [5] myFICO Forums (2024). American First Finance on TU.

MORE FROM savvysc.com