What To Do If Your Financed Car Is Stolen: Steps, Solutions, and Expert Guidance

Introduction: Understanding Car Theft While on Finance

Experiencing car theft is a stressful event, but the situation can become even more complex when the stolen vehicle is still under a finance agreement. Knowing what to do, who to contact, and how your responsibilities change is critical for minimizing financial losses and stress. This guide provides a comprehensive overview for anyone facing the theft of a financed car, covering immediate actions, insurance implications, finance obligations, and ways to protect yourself from unexpected financial burdens.

Immediate Actions: Responding Quickly and Effectively

If your financed car is stolen, it’s essential to act promptly and follow these steps to ensure the best possible outcome:

Source: myautoloan.com

1. Confirm the Theft : Double-check with family members or anyone who might have access to your car to make sure it hasn’t been borrowed without your knowledge. Once certain, proceed immediately to report the theft.

2. Contact the Police : Report the stolen vehicle to your local police department. Provide all relevant details, such as the car’s make, model, color, registration number, and any distinguishing features. You’ll receive a crime reference number, which will be crucial for insurance and finance claims [3] .

3. Inform Your Insurance Provider : Notify your insurer about the theft as soon as possible and supply the crime reference number. Your insurance company will guide you through the claims process and determine whether your policy covers vehicle theft [1] .

4. Notify Your Finance Company : Contact your lender or finance provider. Give them the details of the theft, including the crime reference number and any information from your insurer. It’s crucial to keep them updated throughout the claims process [2] .

Your Financial Obligations: What Happens to Your Payments?

Even if your car is stolen, your financial obligations do not disappear. Here’s what you need to know about continuing your payments and settling your agreement:

Keep Paying Your Installments : As the borrower, you remain responsible for your monthly payments until the finance agreement is settled. This applies whether your car is recovered or not. Missing payments can negatively impact your credit score and may result in additional fees [3] .

Insurance Payouts : If you have comprehensive insurance, your insurer should pay out the market value of the stolen car. The payout typically goes directly to the finance company if the car is financed. Once the claim is processed, your agreement may be settled depending on the payout amount [2] .

Shortfall Liability : Cars depreciate quickly, and sometimes the insurance payout does not cover the full outstanding balance remaining on your finance. If this happens, you are responsible for paying the difference between the payout and your loan balance. This situation is known as a ‘negative equity’ scenario [4] .

GAP Insurance : Guaranteed Asset Protection (GAP) insurance is designed to cover the gap between your car’s current market value (what standard insurance pays) and the remaining finance balance. If you have GAP coverage, your financial responsibility for the shortfall is minimized or eliminated. Without it, you’ll need to pay any remaining balance out-of-pocket [3] .

Step-by-Step Guide: Navigating Insurance and Finance Claims

Handling the theft of a financed car involves coordination between you, your insurer, and your finance provider. Follow these steps to manage the process efficiently:

Step 1: Gather Documentation Compile all relevant documents, including your police crime reference, insurance policy, finance agreement, and vehicle registration. This helps streamline communications and claim processing.

Step 2: Work With Your Insurance Stay in close contact with your insurer. Provide requested documentation promptly, and follow their guidelines for assessing the car’s market value. If the car is recovered, inform both your insurer and finance company. If it is declared a total loss, confirm how the payout will be distributed.

Step 3: Communicate With Your Lender Keep your lender informed at every stage. Once the insurance payout is processed, confirm whether the payout is sufficient to settle the agreement. If there is a shortfall, discuss repayment options or explore new finance arrangements with your lender.

Step 4: Consider GAP Insurance If you do not already have GAP insurance, review your options for future vehicle purchases. GAP coverage can be purchased from insurers, finance providers, or independent brokers. It’s especially beneficial for cars with high depreciation rates or for borrowers with low down payments [5] .

Step 5: Finalize Your Agreement Once all payouts and payments are complete, confirm with your lender that the agreement is closed. Request written confirmation for your records, and update your insurance status accordingly.

Potential Challenges and Solutions

Car theft while on finance presents unique challenges. Here are common issues and how to address them:

Challenge: Insurance Payout Insufficient If your insurance payout does not cover the full amount owed, you will be responsible for the remainder. Solutions include negotiating with your lender for a manageable repayment plan or seeking additional financing. Some lenders may offer hardship programs for borrowers facing unexpected losses.

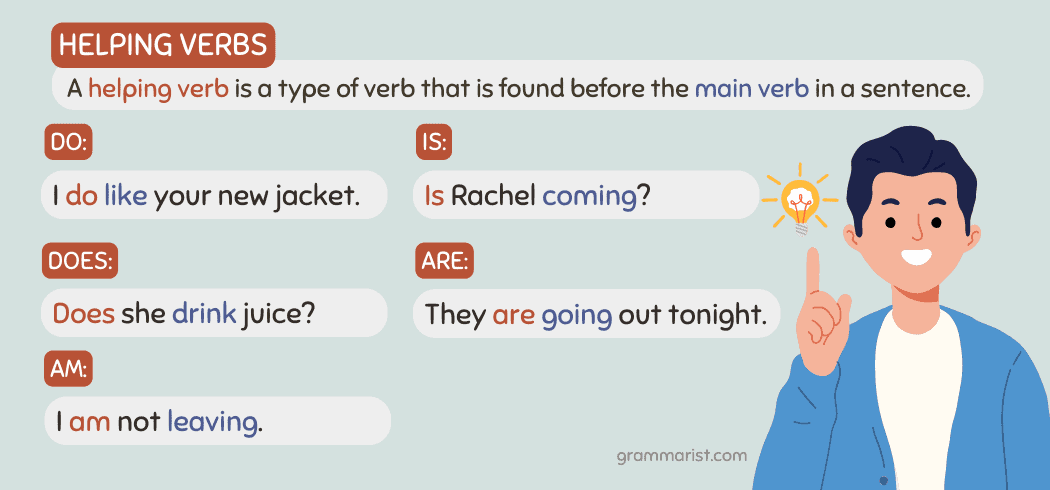

Source: marshfinance.com

Challenge: No Comprehensive Insurance If you lack comprehensive coverage, you may be liable for the entire outstanding balance. In this case, contact your lender to discuss options, which may include restructuring your debt or trading in other assets to cover the loss. It is advisable to maintain comprehensive coverage on financed vehicles to avoid this scenario [1] .

Challenge: Delay in Claims Process Insurance and finance claims can take time to process. To minimize delays, respond quickly to requests for information, keep copies of all correspondence, and communicate regularly with both your insurer and lender.

Real-World Example: Navigating the Process

Consider Sarah, who financed her car through a major lender. One morning, she discovered her car was missing and confirmed it was stolen. She reported the theft to the police and received a crime reference number. She then notified her insurer and finance company. Her insurance payout was less than the loan balance, leaving her with a $2,000 shortfall. Without GAP insurance, Sarah worked with her lender to arrange a payment plan for the difference, allowing her to avoid severe financial hardship. Sarah’s case highlights the importance of coordinated communication and understanding your coverage options.

Practical Guidance: How to Access Support and Information

If you’re dealing with car theft and an outstanding finance agreement, here are ways to access support:

– Contact your insurance provider via customer service phone lines or online portals to start a claim.

– Reach out to your finance company using account management tools or direct customer support numbers. Have your crime reference and insurance claim information ready.

– Explore GAP insurance options by searching official insurance company websites or speaking to your lender about recommended providers. Be sure to verify the legitimacy of any company before purchasing coverage.

– Seek financial counseling through local consumer advocacy groups, financial ombudsman services, or online resources if you struggle to meet payment obligations.

– For vehicle recovery information , use DVLA resources and police departments’ online portals to check the status of your stolen vehicle report.

Alternative Approaches and Preventative Measures

To avoid similar issues in the future, consider these strategies:

1. Invest in comprehensive insurance to safeguard against theft and other major losses.

2. Consider GAP insurance for any new finance agreements, especially for cars with rapid depreciation.

3. Use anti-theft devices and parking in secure locations to reduce the risk of theft.

4. Keep all vehicle documentation organized and accessible.

Summary and Key Takeaways

When your financed car is stolen, you remain responsible for your finance agreement until the insurance claim is resolved. Comprehensive insurance and GAP coverage can help minimize your financial exposure, but you may need to pay any shortfall if your insurance payout is insufficient. Keep communication open with your insurer and lender, and seek professional guidance if necessary. Prevention, timely action, and understanding your options are the best ways to manage car theft on finance.

References

- [1] Marsh Finance (2024). What Happens If Your Car Gets Stolen And You Still Owe?

- [2] Zuto (2024). What Happens If My Car Is Stolen While Still On Finance?

- [3] Carplus (2025). What Happens If Your Car Gets Stolen on Finance?

- [4] Capital One (2023). Your Car Just Got Stolen. Now What?

- [5] Barbary Insurance (2024). What If My Financed Car Is Stolen?

MORE FROM savvysc.com