Finance Lease Assets: Typical Examples and Key Exceptions Explained

Understanding Finance Leases and Asset Types

Finance leases, formerly known as capital leases, play a critical role in business asset management and financial reporting. Under a finance lease, the lessee is granted the right to use an asset for most or all of its useful life, and the risks and rewards of ownership are substantially transferred to the lessee. This structure significantly impacts both the lessee’s and lessor’s financial statements, requiring careful classification and accounting treatment [3] .

Key Criteria for Finance Lease Classification

To determine if a lease should be classified as a finance lease, several criteria must be evaluated. The most commonly used standards, such as ASC 842 and IFRS 16, outline the following key factors:

- Transfer of ownership at the end of the lease term.

- A bargain purchase option that the lessee is reasonably certain to exercise.

- The lease term covers the majority of the asset’s economic life (generally considered 75% or more).

- The present value of lease payments amounts to at least substantially all of the asset’s fair market value (typically 90% or more).

- The asset is of such a specialized nature that only the lessee can use it without significant modification [1] [4] .

If

any

of these criteria are met, the lease is typically classified as a finance lease for the lessee. If not, it is considered an operating lease

[2]

.

Typical Examples of Assets Leased as Finance Leases

The following asset types are commonly found in finance leases, reflecting the intention that the lessee will use the asset for most of its useful life and, in many cases, ultimately acquire it:

- Specialized Machinery : Industrial equipment tailored for a specific process or production line is often leased under finance leases. These assets are usually not easily transferable to another user without significant modifications, making them prime candidates [1] .

- Vehicles : Commercial trucks, delivery vans, and fleet vehicles are frequently leased as finance leases, especially when the lease term is substantial and there is an expectation of ownership transfer or a bargain purchase option at the end of the term [2] .

- Heavy Equipment : Forklifts, cranes, and construction machinery are typically subject to finance leases due to their high value and long useful lives. Lessees often require these assets for core operations and may exercise purchase options at lease-end [4] .

- Manufacturing Equipment : Long-lived equipment used in production facilities is commonly leased as finance leases when the lessee intends to use the asset for most of its productive life.

These examples share commonalities: the assets are durable, have identifiable residual value, and are instrumental to the lessee’s operations for a significant portion of their economic life.

Source: alamy.com

Assets Commonly

Not

Leased as Finance Leases

While many tangible assets can be leased as finance leases, several types are typically excluded from this classification:

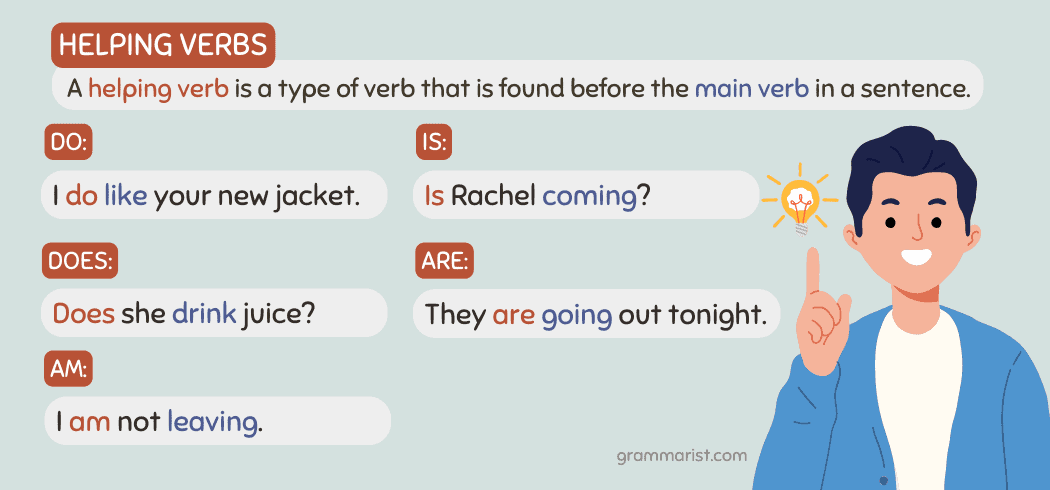

Source: unitedplanet.org

- Short-Term Rentals : Assets leased for brief periods (generally less than 12 months) are usually accounted for as operating leases, not finance leases. Examples include temporary office equipment or vehicles rented for a specific project [2] .

- Office Space and Real Estate : While long-term property leases exist, real estate is often classified as an operating lease unless the arrangement meets strict criteria for finance lease classification. Land, in particular, is generally excluded since it does not have a finite useful life [1] .

- Low-Value Assets : Items such as computers, small office equipment, or other assets with relatively low purchase price are often exempted from capitalization and are treated as operating leases under materiality thresholds [5] .

It’s important to note that not all leased assets qualify as finance leases. For instance, if you are considering a short-term rental of a copier or a month-by-month vehicle lease, these arrangements are unlikely to meet finance lease criteria.

Step-by-Step Guidance for Lease Classification

If you need to determine whether a lease qualifies as a finance lease, you can follow these steps:

- Gather Lease Documentation: Obtain the full lease agreement, including terms, payment schedules, and any purchase options.

- Evaluate Criteria: Compare the lease terms to the finance lease criteria outlined above. Pay close attention to lease length, purchase options, and the asset’s use and value.

- Consult Accounting Standards: Review ASC 842 or IFRS 16, depending on your jurisdiction. Many organizations provide lease accounting guides and tools to assist in this process [2] .

- Record Appropriately: If the lease qualifies as a finance lease, recognize the asset and corresponding liability on your balance sheet, depreciate the asset over its useful life, and amortize the liability accordingly.

- Seek Expert Guidance: For complex or borderline cases, consult with your finance department or a certified public accountant to ensure proper compliance [5] .

For authoritative instructions, you can contact your organization’s finance office or search for “ASC 842 lease classification guide” on official accounting bodies’ websites such as the Financial Accounting Standards Board (FASB).

Real-World Example: Finance Lease for Equipment

Consider a company leasing a forklift for three years, with a fair value of $16,000 and a purchase option at lease end for $1,000. If the lease term covers most of the asset’s useful life and the purchase option is likely to be exercised, this arrangement would typically be classified as a finance lease. The lessee records both the asset and liability, depreciates the equipment, and recognizes interest expense over the lease term [4] .

By contrast, if the same forklift were rented for a short project lasting only a few months with no purchase option, the lease would generally be treated as an operating lease and not capitalized on the balance sheet.

Accessing Support and Further Information

Businesses seeking to classify leases or optimize their lease portfolio can:

- Contact their internal accounting or finance department for guidance specific to their organization’s policies.

- Consult a certified public accountant (CPA) or a professional advisor experienced in ASC 842 and IFRS 16 lease accounting.

- Use search terms like “lease accounting ASC 842 guide” or “IFRS 16 finance lease criteria” to find official resources from accounting standard bodies and professional organizations.

- Look up official guidance from accounting bodies such as the Financial Accounting Standards Board (FASB) or International Accounting Standards Board (IASB) for the most current and detailed information.

If you are unsure about your lease’s classification, you may also reach out to industry associations or attend webinars on lease accounting best practices for practical, real-world advice.

Key Takeaways and Alternatives

In summary, assets such as specialized machinery, vehicles, and heavy equipment are typical examples of finance leases, provided the arrangement meets strict accounting criteria. Excluded from this category are short-term rentals, most real estate leases (especially land), and low-value assets. Proper lease classification is crucial for compliance and financial reporting accuracy, and expert guidance is recommended in ambiguous situations. By following the outlined steps and leveraging official resources, businesses can ensure they handle finance lease accounting in alignment with current standards.

References

- [1] Netgain (2025). Operating vs. finance leases: Journal entries & amortization.

- [2] Insightsoftware (2025). Lease Accounting Examples Guide.

- [3] NetSuite (2022). What Is Lease Accounting? Expert Guide & Examples.

- [4] FinQuery (2024). Capital/Finance Lease Accounting for ASC 842 w/ Example.

- [5] Harvard Financial Administration (2022). Lease Accounting Policy.

MORE FROM savvysc.com