How to Finance a Car After Repossession: Options, Steps, and Solutions

Understanding Car Financing After a Repossession

Experiencing a car repossession can feel overwhelming, especially when you need reliable transportation and wonder if you can qualify for a new auto loan. The good news is that it is possible to finance a car after a repo , but you’ll likely face more hurdles than buyers with clean credit histories. This guide explains how repossession impacts your options, what lenders look for, and practical steps to improve your chances of securing auto financing.

Source: alamy.com

How Repossession Affects Your Credit and Loan Options

A repossession is reported as a significant negative mark on your credit file, typically staying there for up to seven years. This event can lower your credit score by 100 points or more, often pushing you into the

subprime

borrower category. Traditional banks and credit unions may be reluctant to approve loans for applicants with recent repossessions, especially if your score falls below 670

[4]

. However, specialized lenders and dealerships do offer options for customers with damaged credit.

Your Auto Financing Options After a Repo

Even though your choices are narrower, there are several ways to finance a car after repossession:

1. Buy Here Pay Here (BHPH) Dealerships

BHPH dealerships offer in-house financing and often skip traditional credit checks, making them accessible for people with repossessions. However, you should be aware that these loans typically come with much higher interest rates and strict repayment terms. You may also be required to make payments directly at the dealership, and the vehicles offered are usually used with higher mileage [1] [2] .

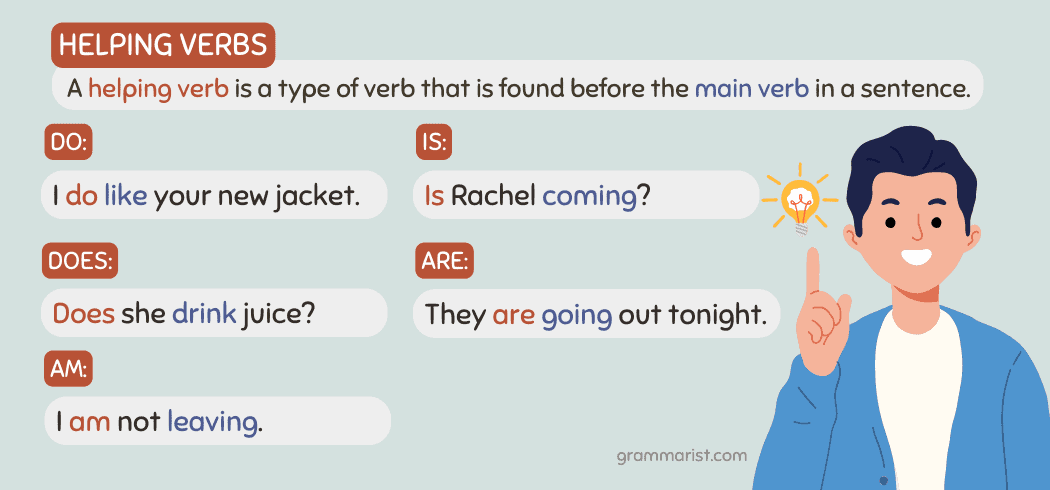

Source: alamy.com

2. Subprime Auto Lenders

Some lenders specialize in loans for borrowers with weak or recent credit issues. These subprime lenders may look beyond your credit score and consider your overall financial situation, such as your income, employment stability, and down payment. Interest rates will still be higher, but you may find more flexibility in loan terms [2] .

3. Larger Down Payments

Providing a substantial down payment shows lenders you are committed and helps offset their risk. A bigger upfront payment can increase your approval odds and may help you secure slightly better rates or terms. Saving up for a down payment is a practical first step before applying for a new car loan [2] .

4. Using a Cosigner

If you have a trusted friend or family member with good credit, asking them to cosign your loan can boost your chances of approval and help you qualify for lower interest rates. The cosigner will be legally responsible for the loan if you fall behind, so this approach should be considered carefully by both parties [3] [2] .

5. In-House Financing Programs

Some dealerships offer their own financing programs tailored for buyers with credit challenges. These programs can be more forgiving, but they tend to come with higher costs. Ensure you understand all terms and fees before signing any agreement [2] .

Step-by-Step Guidance for Securing Car Financing After Repossession

Step 1: Check Your Credit Report

Obtain a copy of your credit report from all three major bureaus. Carefully review it for errors or outdated information. If you spot inaccuracies-such as an incorrect balance or a repossession reported in error-file a dispute to have them corrected. Removing inaccurate negative marks can significantly improve your approval chances [3] .

Step 2: Address Outstanding Debts

If your previous car loan left you with a deficiency balance (the difference between what you owed and what the repossessed car sold for), contact your former lender to arrange a payment plan or negotiate the amount. Clearing or reducing this debt can improve your credit and demonstrate responsibility to new lenders [5] .

Step 3: Save for a Down Payment

The more you can pay upfront, the more likely you are to qualify for financing. Aim to save at least 10% to 20% of the car’s price. Not only does this lower your loan amount, but it may also signal to lenders that you’re less of a risk [2] .

Step 4: Shop Around for Lenders

Don’t accept the first offer you receive. Instead, inquire with multiple lenders, including credit unions, community banks, online lenders, and dealerships with special finance departments. Each lender will have its own criteria and may offer different terms. You can use the search term “auto loans for bad credit” or “subprime auto lenders” to find potential options in your area.

Step 5: Consider a Cosigner

If you have access to a creditworthy cosigner, discuss the arrangement and ensure they understand their responsibilities. Their support can make a significant difference in your loan approval and interest rates [3] .

Step 6: Get Preapproved

Whenever possible, try to get preapproved for a loan before visiting a dealership. Preapproval gives you a clear understanding of the loan amount, terms, and interest rate you qualify for, helping you negotiate more effectively and avoid high-pressure sales tactics [3] .

Common Challenges and Practical Solutions

The biggest obstacles you’ll face include higher interest rates, larger required down payments, and fewer choices of lenders or vehicles. To overcome these challenges:

- Focus on rebuilding your credit by making on-time payments on all accounts

- Consider a less expensive used vehicle to keep your loan amount and payments manageable

- Be wary of predatory lenders-always read the fine print and compare multiple offers

In some cases, waiting 12 months after your repossession can improve your approval odds and help you access better rates [2] .

Alternative Approaches to Getting Back on the Road

If traditional auto financing remains out of reach, consider these alternatives:

- Buy a reliable used car with cash to avoid another loan

- Use public transportation temporarily while you rebuild your credit

- Borrow a car from family or friends until you qualify for better financing

Some nonprofit organizations and community programs offer vehicle assistance for those in need; search terms like “vehicle assistance programs near me” or contact your local United Way for referrals.

Actionable Steps for Moving Forward

To maximize your chances of approval and minimize costs:

- Monitor and improve your credit score over time

- Address all outstanding debts, especially deficiency balances from your repossession

- Save for a larger down payment

- Explore all lending options, including subprime lenders and credit unions

- Consider bringing a cosigner with strong credit

If you are ready to start the process, gather your recent pay stubs, proof of residence, and copies of your credit reports. Contact local banks, credit unions, and dealerships to ask about their policies for applicants with previous repossessions. You can also search for “auto loans after repossession” to find lenders that specialize in these situations.

Summary

Although a prior repossession can complicate your car-buying journey, many buyers successfully finance vehicles afterward by taking practical steps to rebuild credit and pursue alternative lenders. Carefully compare your options, avoid predatory terms, and focus on long-term financial recovery. With time and diligence, you can get back on the road and improve your financial standing.

References

- [1] Experian (2025). Can I Get a Car Loan After a Repossession?

- [2] Credit Acceptance (2025). Multiple Repossessions & Auto Financing

- [3] Lexington Law (2024). 7 ways to get a new car loan after repossession

- [4] Capital One (2022). What You Need to Know About Buying a Car After a Repossession

- [5] Consumer Financial Protection Bureau (2023). What happens if my car is repossessed?

MORE FROM savvysc.com