Step-by-Step Guide to Closing Your M1 Finance Account Safely

Introduction

Deciding to close your M1 Finance account is a significant financial decision. Whether you’re switching brokers, consolidating your investments, or no longer wish to pay monthly fees, understanding the process is crucial. This guide walks you through every step required to safely close your account, avoid common pitfalls, and ensure all funds and investments are handled correctly. We’ll explore best practices, real-world examples, and alternative options to help you make the most informed choice.

Understanding the Implications of Closing Your Account

Before initiating the closure, it’s important to recognize the financial and practical impacts. Closing your M1 Finance account may trigger tax events if you sell investments, and you could be subject to account closure or transfer fees. For example, one user reported a $100 fee for closing or transferring assets , which is typical in the brokerage industry [2] . Always check the most current fee schedule directly on M1 Finance’s official site or contact their support team for up-to-date information.

Pre-Closure Checklist

Preparation is key to a smooth account closure. Here are the essential steps you should take before proceeding:

- Review Your Account Balance: Ensure you know your exact holdings, cash balance, and any pending transactions.

- Identify Recurring Deposits: Disable any automatic transfers or recurring deposits to prevent new funds from entering during the closure process [1] .

- Understand Tax Implications: Selling investments may result in capital gains or losses. Consult with a tax advisor if you’re unsure about the consequences.

- Document All Activity: Download statements and transaction histories for your records.

Step 1: Liquidate Your Investments

To close your account, you must first sell all investments held within your M1 Finance portfolio. On the app or website, navigate to your portfolio, select each investment, and choose to sell. Ensure that all positions are fully liquidated and the cash is available in your account [1] . Be aware that selling may not be instantaneous and could take one or more trading days depending on settlement times.

Example: A user liquidated $6,300 worth of investments, waited for the funds to settle, and then made a manual withdrawal [2] .

Step 2: Withdraw Funds to Your Linked Bank Account

Once your investments are sold and the cash is available, withdraw your funds to your linked bank account. Go to the transfer section of the M1 Finance platform, select your bank, and initiate the transfer. Confirm that the entire cash balance is withdrawn before proceeding with account closure [1] . Some users have reported receiving checks for residual balances, but direct transfer to a bank account is typically faster and more secure.

Step 3: Disable Recurring Deposits and Automatic Transfers

Visit the recurring transfers section and ensure all automatic deposits are paused or canceled. This step prevents additional funds from being added while your account is being processed for closure [1] . Always double-check that no future transactions are scheduled.

Step 4: Contact M1 Finance Customer Support

After your assets are liquidated and withdrawn, reach out to M1 Finance customer support to formally request account closure. Support can be contacted via the app, website, or through their official email. Be prepared to confirm your identity and provide relevant account information. Ask for written confirmation of closure and request documentation that all services and linked features have been terminated [1] .

Contact Options: If you are unable to find a verified direct link for support, use the official M1 Finance website’s help or support section and search for “close account” or “account closure.” This will direct you to their most current contact information.

Step 5: Confirm Closure and Final Account Status

After M1 Finance processes your request, you should receive confirmation that your account is closed. Double-check your account to verify that:

- No funds remain in the account.

- All investments have been sold.

- All services, such as recurring deposits and linked features, are canceled.

Keep all confirmation emails and documentation for your records.

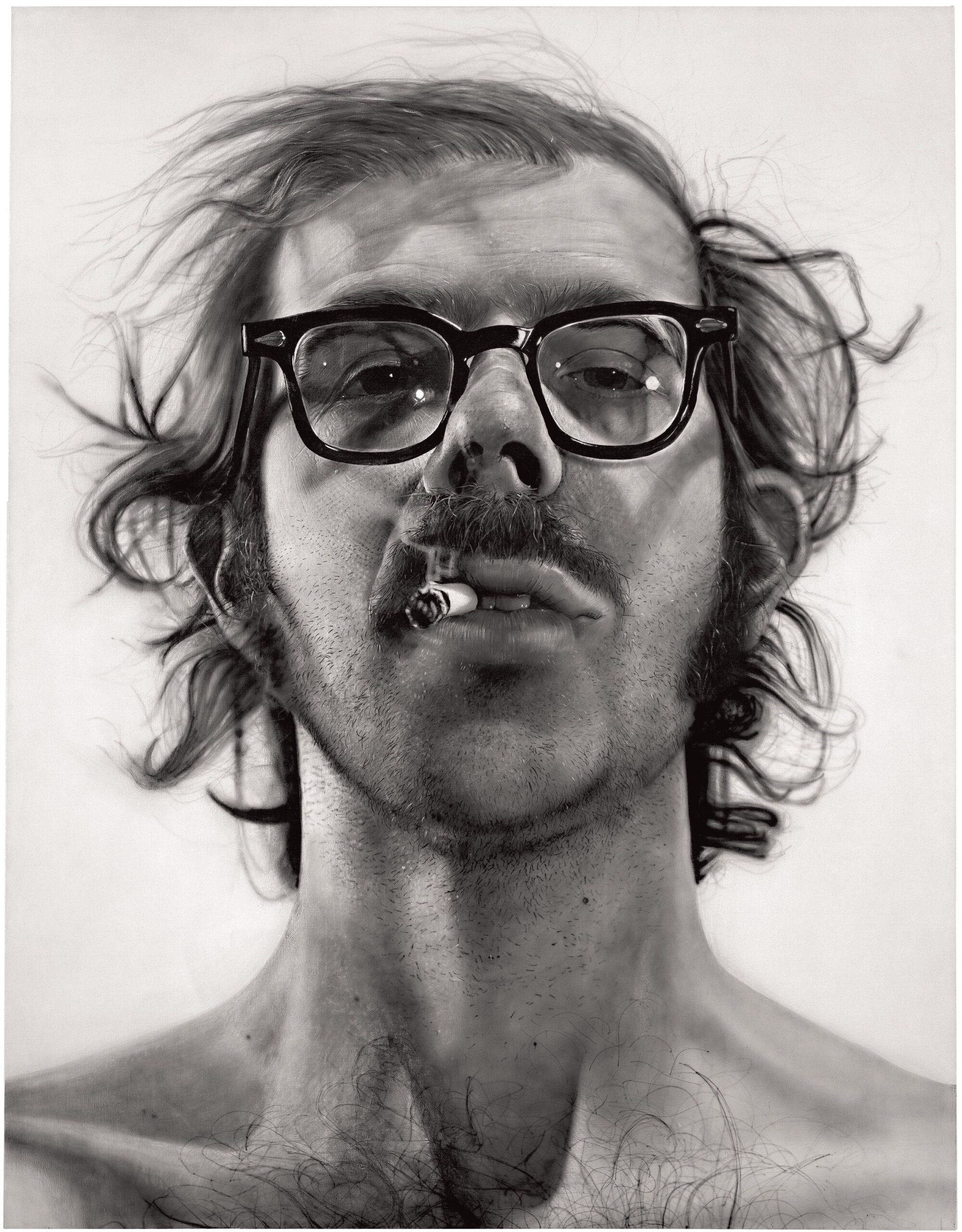

Source: pixabay.com

Alternative Options and Considerations

If you prefer not to sell your investments, you may transfer your assets to another brokerage via an Automated Customer Account Transfer Service (ACATS). Some brokerages, such as Fidelity, allow you to initiate asset transfers online, but note that not all investment types may transfer in-kind [5] . Always check compatibility and potential transfer fees before proceeding. In some cases, brokers like Robinhood offer bonuses or reimburse transfer fees, but you must verify these offers directly with the receiving broker.

Common Challenges:

- Fee Awareness: Confirm any closure or transfer fees with M1 Finance support.

- Residual Balances: If small amounts remain, request a check or direct deposit for the remaining funds.

- Tax Reporting: Retain all closing statements and trade confirmations for future tax filings.

Practical Example: Consolidating Accounts

Many investors close M1 accounts to consolidate assets at another brokerage, such as Fidelity, which offers features like free trades, partial shares, and multiple account types [5] . When transferring, ensure you understand the difference between selling investments and transferring in-kind, as tax consequences may differ.

Source: alamy.com

Summary & Key Takeaways

Closing your M1 Finance account requires careful attention to detail:

- Sell all investments and withdraw funds.

- Disable any recurring deposits.

- Contact customer support for formal closure.

- Consider alternative options such as transferring assets to another broker.

- Be aware of potential fees and tax implications.

Always use official sources and contact methods. If you need further assistance, consider searching M1 Finance’s official FAQ or help center for the latest updates [4] .

References

- [1] HowToUnleashed (2024). How To Close M1 Finance Account? Step-by-step walkthrough.

- [2] Personal Finance Channel (2024). Why I decided to close my M1 account.

- [3] Financial Investor (2020). How To Withdraw From M1 Finance and Liquidate Accounts.

- [4] M1 Finance FAQs (2025). Official help and support resources.

- [5] Fidelity (1998). Transfer Your Assets-Investments to Fidelity.

MORE FROM savvysc.com