Understanding the Defining Clause in Accident and Health Insurance Policies

Introduction to Accident and Health Policy Clauses

Accident and health insurance policies contain specific clauses that serve as the foundation for coverage. Among these, the defining clause -often referred to as the insuring clause -sets the parameters for what losses are covered, the conditions for eligibility, and the scope of benefits. Understanding this clause is critical for both policyholders and those seeking coverage, as it directly impacts claims, exclusions, and overall protection [2] .

What Is the Defining Clause?

The defining or insuring clause is the section of an accident and health insurance policy that specifies the nature of the risks covered and outlines what constitutes a valid claim. For example, it may state: “against the results of bodily injuries sustained while this policy is in force and caused directly and independently of all other causes by violent and accidental means and the results of disease or sickness contracted while this policy is in force.” [2]

This clause establishes:

- The types of incidents covered (accident, sickness, death, dismemberment)

- The requirements for coverage (e.g., injuries must be accidental and independent of other causes)

- Exclusions and limitations (certain events or pre-existing conditions may not be covered)

In simple terms, if your claim fits the definition laid out in this clause, the insurance company is obligated to pay the specified benefits, subject to policy terms [1] .

Key Components of the Clause

Accident and health insurance policies often include several defining elements within the insuring clause:

- Scope of Coverage: Details whether the policy covers accidental injury, death, sickness, or a combination.

- Cause of Loss: Specifies that losses must result from defined events, such as “violent and accidental means.”

- Independence of Cause: Stipulates that covered injuries must be independent of other causes, preventing claims where pre-existing conditions play a role.

- Benefit Provisions: Explains how benefits are calculated-such as lump sum payments for death or weekly indemnity for disability.

For example, a “death and dismemberment” policy may only pay out for major losses like death or loss of limb, whereas a general accident and health policy could include coverage for temporary disability or loss of time [3] .

Practical Steps to Review and Interpret Your Policy Clause

To ensure you fully understand your accident and health policy:

- Request a Copy of Your Policy: Contact your insurer or agent and ask for the full contract, including all riders and endorsements. Policies are legally required to include the defining clause and other standard provisions [4] .

- Identify the Insuring Clause: Look for sections labeled “Insuring Clause,” “Definitions,” or similar. This is typically at the beginning of the contract.

- Analyze Covered Events: Review the language for specifics on covered accidents, sicknesses, and exclusions. Take note of phrases like “directly and independently of all other causes.”

- Assess Exclusions and Limitations: Many policies exclude certain conditions or events. Check for any listed exclusions and compare them to your personal circumstances.

- Seek Clarification: If any part of the clause is unclear, reach out to your insurer, a licensed agent, or a state insurance department for guidance. You can find your state’s insurance department by searching “[Your State] Insurance Department.”

Remember, no agent can change the provisions of your policy unless approved by an executive officer and endorsed in writing [4] .

Real-World Examples of Policy Clauses

Consider the following typical insuring clause language:

“This policy provides insurance against loss resulting from accidental bodily injury, accidental death, or sickness contracted while this policy is in force.”

Policies may be customized based on the insured’s occupation, health status, and risk profile. For instance, some policies are tailored to cover only specific risks, such as injuries sustained in public transport or during travel. Others may offer broader protection, covering both accidental injuries and illnesses [2] .

Example: If you purchase a limited accident policy for travel, the insuring clause might specify coverage only for injuries sustained while using public conveyances, excluding other types of accidents.

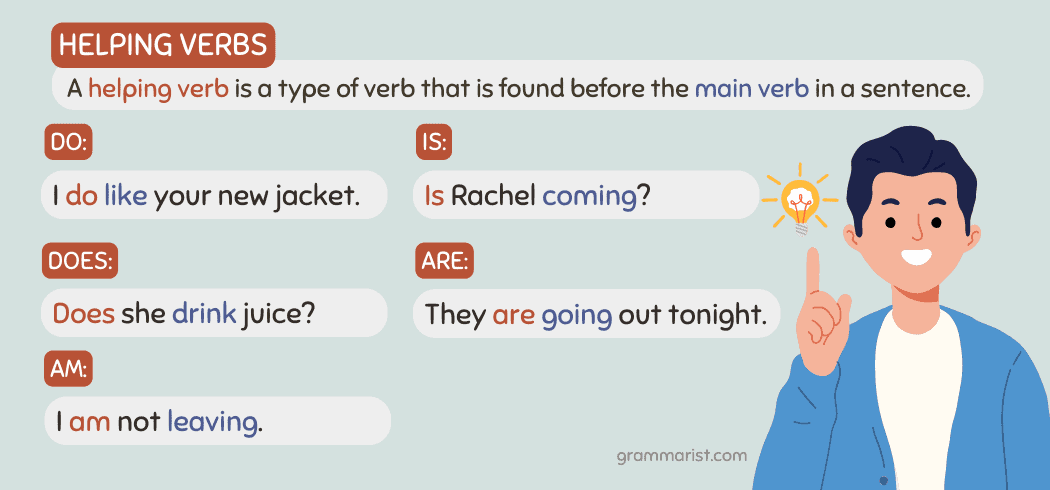

Source: 7esl.com

Challenges and Solutions in Interpreting Policy Clauses

Many policyholders struggle to interpret the legalistic language of insurance contracts. Challenges include:

- Ambiguous Wording: Some clauses use technical jargon or vague terms, leading to confusion about what is covered.

- Hidden Exclusions: Important limitations may be buried in fine print or in separate endorsements.

- Variability Across States: State regulations can affect the wording and requirements of policy clauses, creating differences from one policy to another [1] .

Solutions:

- Read the “Definitions” section carefully, as it clarifies key terms used throughout the policy.

- Contact your insurer or a licensed insurance agent for explanations of unclear language.

- Refer to your state insurance department for consumer guides and information on standard policy provisions.

Alternative Approaches and Additional Protections

If your current accident and health policy does not provide the coverage you need, consider the following alternatives:

Source: eslkidsworld.com

- Supplemental Insurance: Purchase additional policies to cover specific risks not included in your main policy, such as critical illness or travel accident insurance.

- Group Insurance: Many employers offer group accident and health insurance with broader coverage and fewer exclusions.

- Policy Riders: Add riders or endorsements to your existing policy to expand coverage or address specific needs, such as coverage for adopted children [1] .

To explore these options, contact your insurance provider and request information on supplemental policies, group plans, and available riders. You may also visit your state’s insurance department website for consumer resources and guidance.

Step-by-Step Guidance for Policyholders

Here is an actionable pathway for understanding and leveraging your policy’s defining clause:

- Review the “Definitions” and “Insuring Clause” sections of your policy.

- Make a list of covered events, exclusions, and limitations.

- Compare your needs (e.g., occupation, health status, family situation) to the policy’s coverage.

- If additional coverage is needed, inquire about supplemental policies or riders.

- Use official resources, such as your state’s insurance department, for unbiased consumer advice.

For further assistance, search for “[Your State] Insurance Department consumer guide accident health insurance” or contact a licensed insurance agent in your area.

Key Takeaways

The defining clause in an accident and health insurance policy is the cornerstone of your coverage. By understanding its language, reviewing your policy carefully, and seeking clarification when needed, you can ensure that you are adequately protected and fully aware of your rights and obligations as an insured. Always use official resources and licensed professionals when evaluating or purchasing insurance products.

References

- [1] Texas Statutes (2023). Accident and health insurance policy definitions and coverage.

- [2] Casualty Actuarial Society (1931). The Contract of Personal Accident and Health Insurance.

- [3] Iowa Legislature (2007). Definition of accident and sickness insurance policy.

- [4] Oklahoma Statutes (2024). Required accident and health policy provisions.

MORE FROM savvysc.com