Understanding ISOs in Finance: Independent Sales Organizations Explained

Introduction to ISOs in Finance

In the modern financial landscape, Independent Sales Organizations (ISOs) play a pivotal role in enabling businesses to accept and process electronic payments. As commerce continues to shift toward digital transactions, understanding what an ISO is-and how it can benefit your business-is essential for entrepreneurs, small business owners, and anyone interested in payment processing solutions. [1] [2]

What is an ISO?

An ISO is a third-party company that acts as an intermediary between businesses (merchants) and acquiring banks or payment service providers. ISOs are authorized to market and sell credit card processing services, set up merchant accounts, and provide the infrastructure necessary for accepting credit and debit card payments. They operate independently but form essential partnerships with financial institutions and card networks like Visa and Mastercard. [3] [4]

Core Functions of an ISO

ISOs offer a range of services designed to simplify and enhance payment processing for businesses. Their key functions include:

Source: velp.com

- Merchant Account Setup: ISOs help businesses establish merchant accounts, which are specialized bank accounts that enable acceptance of card payments. [3]

- Payment Processing Solutions: They provide the technology and support needed to process credit and debit card transactions, including online gateways and physical point-of-sale (POS) systems. [4]

- Equipment Sales or Leasing: Many ISOs offer card readers, terminals, and other payment equipment for sale or lease.

- Customer Support: ISOs deliver troubleshooting and ongoing support to resolve payment system issues.

- Value-Added Services: Some ISOs provide analytics, security solutions, fraud prevention, and integration with other business platforms. [3]

ISOs vs. PayFacs: Key Differences

It’s important to distinguish between ISOs and Payment Facilitators (PayFacs) . While both facilitate payment processing, their structures and risk profiles differ:

- ISOs refer merchants to acquiring banks and help set up merchant accounts, often working with multiple banks. [1]

- PayFacs operate a single master account with a bank and onboard sub-merchants under their umbrella, assuming greater risk and liability for payment issues and disputes. [4]

Choosing between an ISO and a PayFac depends on your business’s size, risk profile, and specific payment needs.

Benefits of Partnering with an ISO

Businesses can realize several advantages by working with a reputable ISO:

- Flexibility and Customization: ISOs often provide tailored solutions for small and mid-sized businesses, including high-risk industries that traditional banks may avoid. [2]

- Personalized Service: ISOs may offer dedicated support, faster response times, and more adaptable contract terms compared to larger financial institutions.

- Industry Expertise: Many ISOs specialize in particular sectors, allowing them to deliver solutions that address unique industry challenges.

- Regulatory Compliance: Registered ISOs must meet rigorous standards for security and compliance, making them a reliable option for payment processing. [2]

How to Partner with an ISO: Step-by-Step Guide

Engaging an ISO for your business involves several steps:

- Assess Your Payment Needs: Determine what payment methods you want to accept (credit cards, mobile payments, online gateways) and identify any industry-specific requirements.

- Research ISOs: Seek out ISOs with strong reputations, relevant industry expertise, and transparent contract terms. You can find ISOs by searching for “registered ISO payment processing” or consulting industry forums and business associations.

- Evaluate Technology and Support: Review the ISO’s technology stack, integration capabilities, and customer service offerings. Look for compatibility with your existing systems and the ability to scale as you grow.

- Check Registration and Compliance: Verify that the ISO is registered with major card networks (Visa, Mastercard) and sponsored by an acquiring bank. Ask for documentation to confirm compliance. [4]

- Negotiate Terms: Discuss pricing, contract length, service fees, and any additional charges. Get all terms in writing and review the agreement carefully before signing.

- Onboard and Integrate: Work with the ISO to set up your merchant account, install payment equipment, and train staff on usage and troubleshooting.

- Monitor Performance: Regularly review transaction reports, customer service responsiveness, and the effectiveness of value-added services. Adjust your agreement as needed to meet changing business needs.

For additional guidance, you can contact your local bank or industry trade group for recommendations on reputable ISOs. Always ensure you are dealing with a registered and compliant organization.

Potential Challenges and Solutions

While ISOs offer many benefits, there are potential challenges to consider:

- Hidden Fees: Some ISOs may include undisclosed charges or complex fee structures. Solution: Request a detailed breakdown of all costs and review the contract carefully.

- Service Quality Variability: Support levels can vary widely between ISOs. Solution: Seek references and reviews from other merchants in your industry.

- Compliance Risks: Not all ISOs maintain the same standards for regulatory and security compliance. Solution: Verify registration and compliance documentation before entering an agreement.

Alternative Approaches

If an ISO does not meet your needs, alternative payment processing approaches include:

- Partnering directly with an acquiring bank or major payment processor.

- Using an all-in-one payment platform like Stripe, Square, or PayPal, which integrates payment processing, merchant services, and analytics. [3]

- Exploring Payment Facilitators (PayFacs) for rapid onboarding and streamlined services, though with different risk profiles.

Case Studies: ISOs in Action

Consider the following examples to illustrate how ISOs operate:

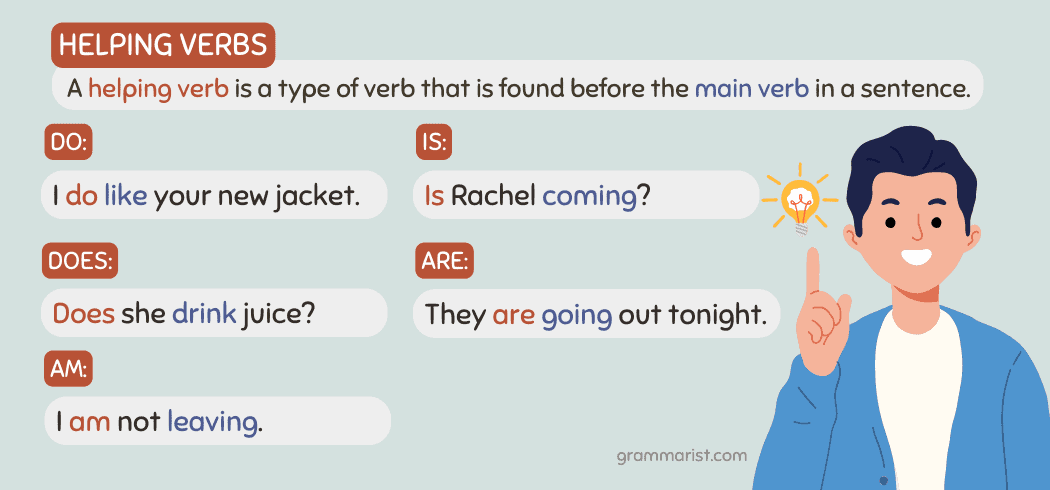

Source: isocouncil.com.au

- Retail Startup: A new retail business needs to accept credit card payments. By partnering with an ISO, they quickly set up a merchant account, lease POS equipment, and start accepting payments within days. The ISO provides ongoing support and analytics, helping the retailer optimize sales.

- High-Risk Industry: A business in a high-risk sector (e.g., travel, adult services) faces rejection from traditional banks. An ISO specializing in high-risk merchant accounts offers tailored payment solutions and risk management services, enabling the business to operate smoothly.

Key Takeaways

ISOs are essential partners in the payments ecosystem, offering businesses flexibility, personalized support, and access to advanced payment solutions. By understanding how ISOs operate, evaluating your specific needs, and following careful selection and onboarding steps, you can leverage these organizations to build a robust financial foundation for your business.

References

- Checkout.com (2023). What is an ISO (Independent Sales Organization) in Payments?

- Stax Payments (2025). What Is An ISO? How Independent Sales Organizations Work.

- Stripe (2023). What is an independent sales organization (ISO)?

- Swipesum (2025). Payment Processing ISO: What is an ISO & What is their role.

MORE FROM savvysc.com