Mastering Personal Finance in High School: Essential Skills for Lifelong Success

Introduction: Why Personal Finance Matters in High School

Personal finance education equips high school students with the practical skills needed to manage money, make informed financial decisions, and lay the groundwork for a secure future. In today’s economy, financial literacy is no longer optional-it’s essential. By learning personal finance early, students gain confidence in budgeting, saving, understanding credit, and more, preparing them for real-world challenges after graduation [1] .

What Is Personal Finance in High School?

Personal finance in high school refers to structured programs and courses that teach students the fundamentals of managing money, from earning and saving to spending, investing, and protecting themselves financially. These programs typically cover:

- Budgeting and money management

- Saving and investing

- Credit and debt

- Consumer skills

- Tax basics

- Insurance and risk management

- Financial aid and educational ROI

Leading curricula, such as EVERFI’s Financial Literacy Foundations, Next Gen Personal Finance (NGPF), and NEFE’s High School Financial Planning Program, provide interactive lessons and real-life scenarios so students can practice making financial decisions [1] , [3] .

Key Concepts Taught in High School Personal Finance Courses

Budgeting and Money Management

Students learn to create and manage budgets, track spending, and allocate resources for short- and long-term goals. Real-world examples include planning for prom expenses, saving for a car, or managing a part-time job paycheck. Actionable steps for students:

- List all sources of income (allowances, part-time work, gifts)

- Track monthly expenses using digital tools or a simple spreadsheet

- Set saving goals for specific purposes (college, emergency fund)

- Review and adjust budgets monthly to reflect changing priorities

Students can start by using free budgeting apps or printable templates available through reputable educational programs [1] .

Saving and Investing

High school personal finance curricula emphasize the importance of saving early and understanding basic investment principles. Students explore interest rates, compound growth, opportunity cost, and the time value of money [2] . For example, a lesson might show how saving $10 a week can grow over years with interest. Implementation guidance:

- Open a savings account at a local bank or credit union with parental guidance

- Compare interest rates and terms

- Learn about certificates of deposit (CDs) and basic investment vehicles

To explore options, students can visit their local bank or use online financial literacy resources recommended by their school.

Credit and Debt

Understanding how credit works is critical for teens. Lessons cover credit scores, how to responsibly use credit cards, and the dangers of debt. Students also learn about loans, including student loans, auto loans, and mortgages [2] . Step-by-step guidance includes:

- Reviewing sample credit reports and scores

- Discussing the impact of late payments and debt accumulation

- Learning safe online practices to prevent identity theft

- Investigating cost vs. benefit of borrowing

Some programs offer simulated credit applications and budgeting exercises to reinforce these lessons.

Source: bridgeportequip.com

Consumer Skills and Smart Money Habits

Personal finance courses teach students to evaluate products, compare prices, and identify reliable sources of information before making purchases [1] . Examples include researching laptops for school or choosing a phone plan. Students are guided to:

- Check multiple reviews and official retailer websites

- Compare product warranties and return policies

- Analyze advertising and marketing tactics

For major purchases, students may practice making a purchase plan and presenting it to a class.

Taxes and Income

High school financial education explains how taxes affect income, why taxes exist, and how to file basic tax returns. Students may complete mock W-2 forms, calculate take-home pay, and understand payroll deductions [4] . Implementation steps:

- Request a sample pay stub from a part-time job or use online calculators

- Discuss federal, state, and local tax responsibilities

- Complete a simulated tax filing exercise in class

Students can learn more about taxes by searching for IRS resources on teen income and tax basics.

Insurance and Risk Management

Students learn about different types of insurance, such as health, auto, and renters insurance, and how insurance protects against financial loss. For example, a lesson may cover the benefits and costs of auto insurance for new drivers. Actionable steps:

- Identify types of insurance relevant to teens

- Research coverage options and costs with guidance from parents

- Discuss scenarios for when insurance is needed

Students can ask family members about their own experiences with insurance or research policies through official insurance company websites.

How to Access Personal Finance Education in High School

Many schools offer personal finance as a standalone course or integrate it into economics, math, or business classes. In states like Michigan, students may fulfill personal finance requirements via approved career and technical education programs or by passing a standardized assessment [5] . To get started:

- Ask your school counselor or principal which personal finance classes are available

- If your school does not offer a course, request information about online or community-based programs

- Explore free digital programs such as EVERFI’s Financial Literacy Foundations for grades 9-12 [1]

- Consider homeschooling curricula like Personal Finance Illustrated® [2]

- Utilize non-profit resources from organizations such as Next Gen Personal Finance and NEFE [3]

Many states provide guidance through their Department of Education websites. Search for “personal finance standards” and review requirements for your location.

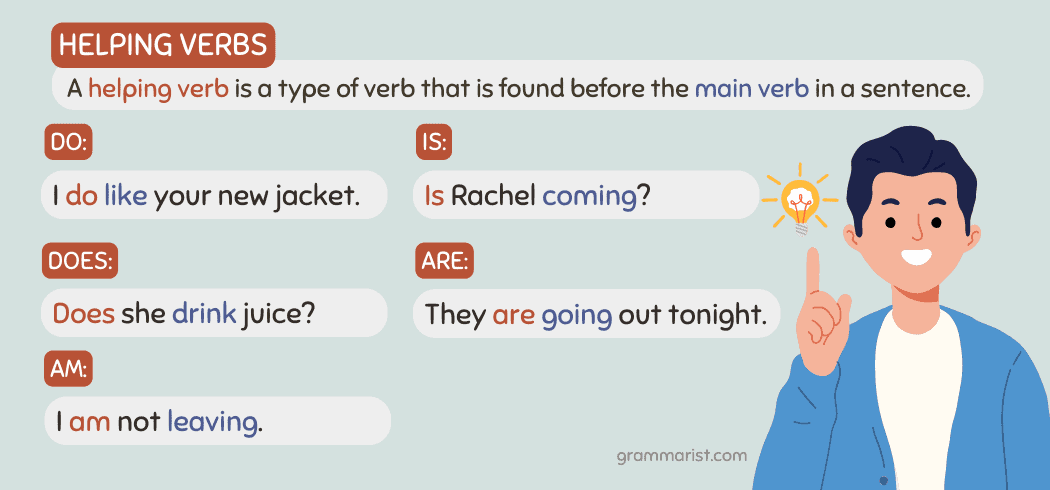

Source: tumblr.com

Practical Applications and Real-World Impact

Personal finance in high school prepares students to handle real-life financial decisions. Case studies show that students who complete these courses are more likely to:

- Create and stick to budgets

- Establish emergency savings

- Avoid unnecessary debt

- Make informed decisions about college, career, and major purchases

For example, a student who learned about interest rates and loan terms may choose a lower-cost student loan and save thousands over time. Another student, aware of the risks of overspending, may avoid credit card debt by setting spending limits and tracking purchases.

Challenges and Solutions in Implementing Personal Finance Education

Some schools face barriers such as limited resources, lack of trained teachers, or competing curriculum priorities. Solutions include:

- Utilizing free, high-quality online resources and curricula [3]

- Encouraging professional development for teachers

- Engaging parents and community organizations for support

- Offering flexible, self-paced modules for students

Students and families can advocate for more comprehensive financial education by contacting school boards, participating in community forums, and sharing their own experiences.

Alternative Pathways and Additional Resources

If your school doesn’t yet offer personal finance, you can:

- Enroll in free online courses from verified providers like EVERFI [1]

- Use curriculum from Next Gen Personal Finance or NEFE, available to both students and educators [3]

- Ask local banks or credit unions about youth financial literacy programs

- Join community workshops through libraries or non-profit organizations

Search for “high school financial literacy program” and include your state or district for tailored results. For official updates, visit your state’s Department of Education website and review personal finance requirements and accredited options.

References

- EVERFI (2025). Financial Literacy for High School Students.

- Not That Hard to Homeschool (2025). Personal Finance Curriculum for High School.

- TeachFinLit.org (2025). Full Curriculum for New Teachers.

- Federal Reserve Education (2025). Making Personal Finance Decisions Curriculum.

- State of Michigan (2025). Personal Finance Course/Credit Requirement.

MORE FROM savvysc.com