Understanding Charitable Gaming: Laws, Benefits, and How Nonprofits Can Participate

What Is Charitable Gaming?

Charitable gaming refers to the operation of games of chance by nonprofit or charitable organizations to raise funds for their missions. These activities include events such as bingo, raffles, casino nights, poker tournaments, and similar games. The primary purpose is to generate revenue for charitable, educational, religious, civic, or other nonprofit causes. Charitable gaming is regulated at the state level, and the rules governing which organizations may participate, the types of games allowed, and how proceeds must be used vary significantly from one jurisdiction to another [1] [5] .

Types of Charitable Gaming Activities

Common forms of charitable gaming include:

- Bingo: Often the most familiar charitable game, it is typically run at community centers, churches, or nonprofit venues. In most states, bingo is carefully regulated, and proceeds must support the host organization’s charitable mission [1] .

- Raffles: Organizations sell tickets for a chance to win a prize. Only certain types of tax-exempt organizations are permitted to host raffles, and there are rules regarding registration, ticket sales, and how the proceeds are distributed [1] .

- Casino Nights & Poker Tournaments: Nonprofits may host casino-themed events where participants play games such as poker, blackjack, or roulette for fun or prizes, with proceeds going to the charity. These events are often subject to different licensing requirements and may be restricted in some states [4] .

- Pull-Tabs & Instant Games: These are similar to lottery scratch-off tickets and are often sold at events or locations affiliated with the nonprofit [2] .

Who Can Conduct Charitable Gaming?

Not all organizations can legally conduct charitable gaming. Eligibility usually requires the organization to be recognized as tax-exempt under IRS code sections such as 501(c)(3), 501(c)(4), 501(c)(6), or similar. Many states also require organizations to have existed for a minimum period (often one year) and to have a clear charitable mission [1] [5] . Some states restrict gaming activities to organizations that advance causes like education, religion, health, or civic improvement [3] .

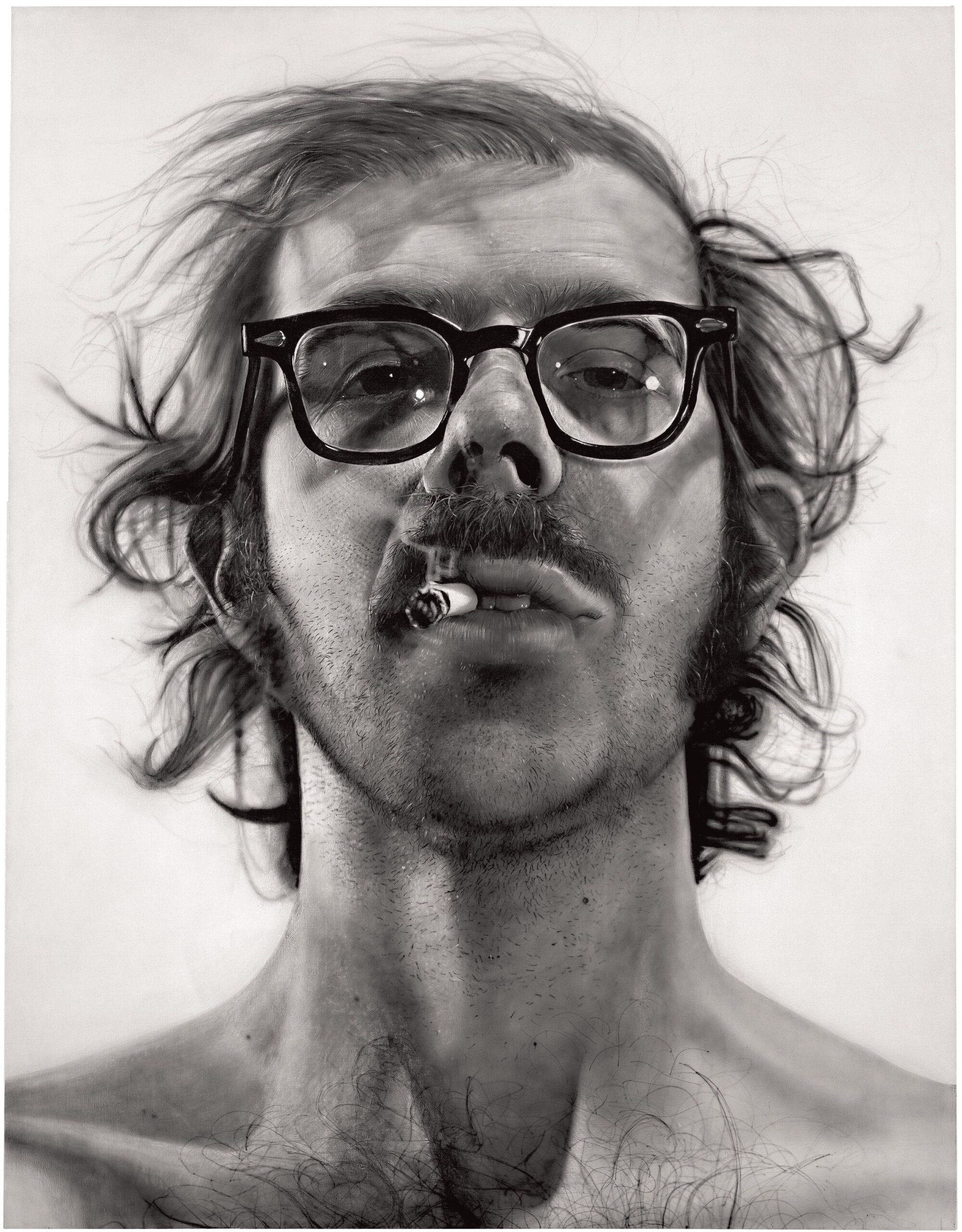

Source: charitablegaming.ca

Legal and Tax Considerations

Charitable gaming is subject to comprehensive regulation. States typically require licenses for each event or type of game, and each has specific compliance requirements. For example:

- In Ohio, organizations must consult the Ohio Revised Code and often need a license from the state Attorney General. Violations can result in criminal penalties [1] .

- New York requires registration for raffles expected to generate more than $5,000 in net proceeds. The organization must obtain a Games of Chance Identification Number from the Gaming Commission [5] .

- Michigan defines “bona fide members” and “charitable purpose” explicitly for eligibility, and licenses are needed for each gaming event [3] .

On the federal level, proceeds from charitable gaming may be subject to unrelated business income (UBI) tax if the activity is not substantially related to the organization’s exempt purpose. There are exceptions for certain bingo games, volunteer-run events, and traditional entertainment activities. Additionally, nonprofits must withhold taxes on winnings over $5,000 and may be required to pay excise taxes on some gaming activities. Consulting with a CPA familiar with nonprofit tax law is highly recommended [2] .

How to Start a Charitable Gaming Program

Launching a charitable gaming event involves several carefully regulated steps. Here’s a typical process:

- Determine Eligibility: Confirm your organization’s tax-exempt status and ensure your mission aligns with state requirements. Check your state’s list of qualifying organizations.

- Select Your Game Type: Choose from bingo, raffles, casino nights, etc., based on what state law allows for your type of organization.

- Apply for Required Licenses: Most states require you to apply for a gaming license or identification number. You’ll need to provide information about your organization, the planned event, and how proceeds will be used. Visit your state’s official gaming or charitable division for forms and instructions. For instance, in Ohio, review the Attorney General’s guidance and refer to the Ohio Revised Code [1] . In New York, visit the Gaming Commission’s charitable gaming division [5] .

- Develop Internal Controls: Establish procedures to account for ticket sales, prize payouts, and how funds will be distributed. Many states require detailed records and may conduct audits to ensure compliance [5] .

- Promote Your Event: Use permitted advertising channels. Some states allow online and TV advertising, while others may restrict certain methods [5] .

- Conduct the Event: Follow all state and local laws during the event. Post all required licenses at the venue and use only approved gaming equipment. Ensure that only eligible individuals participate.

- Report and Distribute Proceeds: After the event, report proceeds to your state authority and distribute funds as required. All proceeds must support your charitable mission, and detailed reporting may be required [1] .

Real-World Examples

Charitable gaming is widespread across the United States. For example, a local 501(c)(3) animal shelter in Ohio can host a bingo night to raise money for veterinary care. A New York PTA may run a raffle during its annual carnival, provided it registers and obtains the necessary identification number if prizes are expected to exceed $5,000 in value. Many religious organizations use gaming events to fund community outreach or youth programs. In all cases, the organization must comply with relevant state and federal rules to protect its tax-exempt status and ensure the event is legally conducted [1] [5] .

Potential Challenges and Solutions

Charitable gaming can be an effective fundraiser, but it comes with challenges:

- Compliance Risk: Navigating state and federal regulations requires careful attention. Noncompliance can result in fines, loss of tax-exempt status, or even criminal penalties. Solution: Consult your state’s regulatory authority and seek legal advice if needed.

- Tax Liability: Events may trigger unrelated business income tax or excise taxes. Solution: Work with an accountant experienced in nonprofit taxation to understand and mitigate risks [2] .

- Recordkeeping: Detailed records are essential and may be audited by state authorities. Solution: Use accounting software or dedicated event management tools to track sales and payouts.

- Eligibility Restrictions: Not all organizations or game types are permitted in all states. Solution: Review your state’s statutes and consult with the appropriate regulatory body.

Alternative Fundraising Approaches

If charitable gaming is not permitted or practical in your state, consider other fundraising methods:

- Online Fundraising: Crowdfunding platforms, virtual events, or online auctions can raise funds without the legal complexities of gaming.

- Traditional Events: Galas, walkathons, and charity dinners remain popular and have fewer regulatory hurdles.

- Direct Appeals: Mail or email campaigns targeting supporters can generate significant contributions without gaming elements.

How to Get Started: A Step-by-Step Guide

If your organization is interested in charitable gaming, follow these steps:

- Research your state’s charitable gaming laws by visiting the official website of your state’s attorney general, gaming commission, or department of revenue.

- Verify your organization’s eligibility and review application requirements for gaming licenses.

- Contact your state’s regulatory authority for clarification and assistance. Many agencies offer phone support, email contacts, and downloadable guides.

- Consult with a CPA or attorney experienced in nonprofit law to address tax implications and compliance requirements.

- Develop a plan for the event, including marketing, operations, reporting, and distribution of proceeds.

For more details, you can search “charitable gaming” along with your state name in your preferred search engine or visit your state’s official gaming or charitable division.

Source: charitablegaming.ca

References

- [1] Charitable Gaming – Ohio Attorney General (2023). Official guidance on charitable gaming in Ohio.

- [2] Walz Group CPA (2024). Rules for Charitable Gaming Activities.

- [3] Michigan Bureau of State Lottery (2024). Charitable Gaming Administrative Code.

- [4] IRS (2016). Update on Gaming Activities for Exempt Organizations.

- [5] New York State Gaming Commission (2024). Division of Charitable Gaming.

MORE FROM savvysc.com